US supply and potential Iran deal have Crude back on the run

Head of Commodity Strategy at Saxo Bank Ole Sloth Hansen

The rising dollar has become one of the most watched features and one the biggest drivers across most asset classes. During the past month the Greenback has rallied by almost 5% against a basket of 10 leading global currencies, as improved US growth prospects have brought closer the first official rate hike in more than a decade.

The current demand for dollars has been brought about by the divergence between central banks. This week, the Bank of Korea became the 23rd central bank so far this year to ease monetary policy.

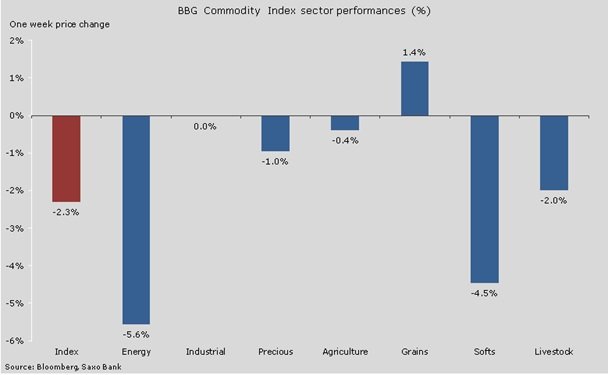

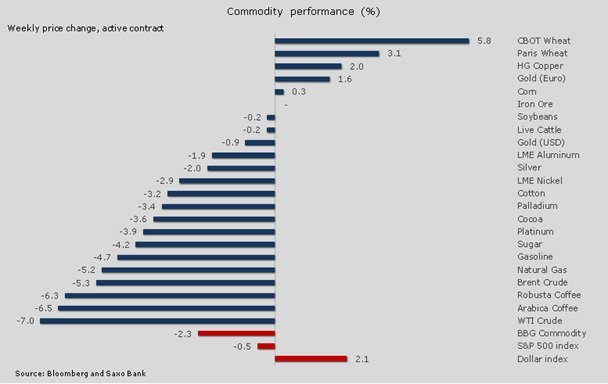

The negative impact of the rising dollar was felt across the commodity sector, with the broad-based Bloomberg commodity index falling by 2.3%, while the dollar rose by almost the same percentage and this brought the index close to a new 12-year low.

The soaring dollar has impacted a host of commodities. Photo: iStock

The energy sector was also hurt by the prospect of a continued rise in US inventories while precious metals have begun nervously looking ahead to next week's Federal Open Market Committee meeting.

The soft sector remains under pressure from weaker cocoa, sugar and coffee prices, mainly brought about by the strength of the dollar compared with the currencies of some of the main producers of these items.

Industrial metals were mixed with losses in nickel and aluminum being off-set by higher copper prices. With China's growth prospects slowing and inventories rising the outlook for further price rises at this stage remain limited.

The best performing commodity was wheat which saw the biggest weekly climb in four months. Inventory levels were revised lower while lack of moisture across the U.S. plains are showing signs of stressing the winter crop as it is about to emerge from dormancy.

Gold has struggled to put up a fight against the surging dollar and has fallen for nine days in a row, something that was last seen in 1973. The only consolation was the fact that it managed to fall less than the amount that the dollar rose, resulting in a positive week for gold priced in euros.

EURUSD is now within striking distance of parity and with forecasts from a major investment bank that it will plunge through, the near-term outlook for gold is weak.

Next week's FOMC meeting will be a key event for precious metals as the market looks for clues as to when US rates will be raised.

The sharp rise in the dollar will undoubtedly make the first quarter a very challenging one for US export companies and growth could also suffer which may sway the FOMC towards a less hawkish and for gold supporting stance.

The area around $1,150/oz offered support back in November and so far this has been repeated. A break however would signal a move to and a test of the November low at $1,132/oz. The upside potential is currently limited to $1,176/oz or possibly $1,185/oz while it would take a move back above $1,195/oz to turn the sentiment back to neutral.

Source: Saxo Bank

WTI crude oil was back on the defensive after breaking away from $50 around which it had been trading for the past month. US production and inventories both continue to rise despite a sharp reduction in active oil rigs.

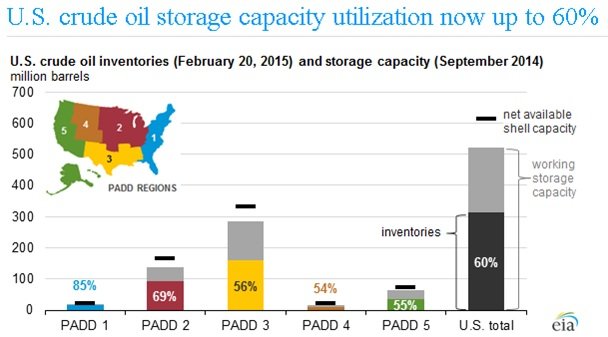

The US's ability to store all this surplus crude has increasingly been attracting some attention, leaving the path of least resistance once again to the downside. The US Energy Information Administration reported on March 4 that US storage facilities were 60% full as of February 20.

The International Energy Agency highlighted this in its monthly report Friday, where it sees the US oil glut worsening leading to a potential test of storage capacity limits. Getting anywhere close to these limits would most likely trigger renewed price weakness in order to force a more substantial cut in production.

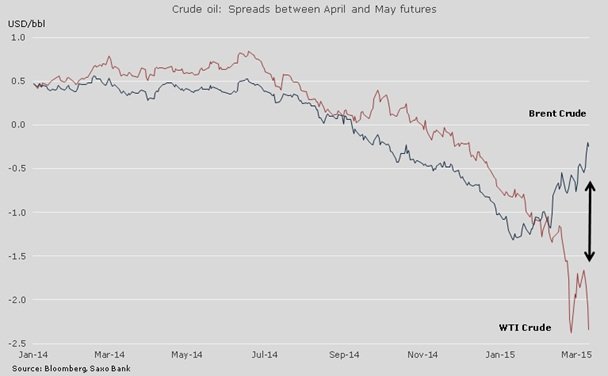

The reaction in the market was to send WTI crude oil down to a six-week low, not least due to the widening contango or spread between the prompt future of April and May. Brent crude is currently a bystander and managed a better performance, not least due to the divergence in April/May futures spreads as seen below.

Apart from US inventories, Iran also received some attention as it is reportedly actively seeking potential buyers for the extra crude it will be able to export should the current nuclear negotiations reach a successful conclusion.

The IEA has estimated that Iran would be able to ramp up exports by 800,000 barrels per day in just three months. Imagine what impact this would have on global supplies and the price of Brent crude at this stage.

Iran is reportedly in talks to sell buyers more crude if sanctions are lifted. Photo: iStock.

Furthermore, it would increase pressure on Opec as its total production could then easily surpass 31 million barrels per day, more than one million above their current target. Also considering that Libya, against all the odds, has managed to increase production and exports during the past few weeks despite the anarchy currently witnessed across the war-torn country.

Having left $50/barrels behind and with the cost of holding long positions through exchange-traded products and futures now costing more than 12% to hold over the next three months the risk of further losses have increased. Technically the latest movements signals a move down to $45.3 on CLJ5 followed by this cycle low at $43.58.

Source: Saxo Bank

https://www.tradingfloor.com/posts/hansen-oil-slips-lower-while-gold-looks-dull-3978022

--

About Ole S. Hansen:

Ole Sloth Hansen is a specialist in all traded Futures, with over 20 years’ experience both on the buy and sell side. Hansen joined Saxo Bank in 2008 and is today Head of Commodity Strategy focusing on a diversified range of products from fixed income to commodities. He previously worked for 15 years in London, most recently for a multi-asset Futures and Forex Hedge fund, where he was in charge of the trade execution team. He is available for comments on most commodities, especially energies and precious metals.

About Saxo Bank

Saxo Bank is a leading online trading and investment specialist, offering private investors and institutional clients a complete set of tools for their trading and investment strategies. Its financial community portal, TradingFloor.com, is the first multi-asset social trading platform. A fully licensed and regulated European bank, Saxo Bank enables clients to trade FX, CFDs, ETFs, Stocks, Futures, Options and other derivatives on our award-winning SaxoTrader platform, accessible on PCs, tablets or smartphones through a single account and available in more than 20 languages. The platform is white-labelled by more than 100 major financial institutions worldwide. Saxo Bank also offers professional portfolio and fund management as well as traditional banking services through Saxo Privatbank. Founded in 1992, Saxo Bank is headquartered in Copenhagen and has offices in 25 countries throughout Europe, Asia, the Middle East, Latin America, Africa and Australia.

The rising dollar has become one of the most watched features and one the biggest drivers across most asset classes. During the past month the Greenback has rallied by almost 5% against a basket of 10 leading global currencies, as improved US growth prospects have brought closer the first official rate hike in more than a decade.

The current demand for dollars has been brought about by the divergence between central banks. This week, the Bank of Korea became the 23rd central bank so far this year to ease monetary policy.

The negative impact of the rising dollar was felt across the commodity sector, with the broad-based Bloomberg commodity index falling by 2.3%, while the dollar rose by almost the same percentage and this brought the index close to a new 12-year low.

The soaring dollar has impacted a host of commodities. Photo: iStock

The energy sector was also hurt by the prospect of a continued rise in US inventories while precious metals have begun nervously looking ahead to next week's Federal Open Market Committee meeting.

The soft sector remains under pressure from weaker cocoa, sugar and coffee prices, mainly brought about by the strength of the dollar compared with the currencies of some of the main producers of these items.

Industrial metals were mixed with losses in nickel and aluminum being off-set by higher copper prices. With China's growth prospects slowing and inventories rising the outlook for further price rises at this stage remain limited.

The best performing commodity was wheat which saw the biggest weekly climb in four months. Inventory levels were revised lower while lack of moisture across the U.S. plains are showing signs of stressing the winter crop as it is about to emerge from dormancy.

Gold has struggled to put up a fight against the surging dollar and has fallen for nine days in a row, something that was last seen in 1973. The only consolation was the fact that it managed to fall less than the amount that the dollar rose, resulting in a positive week for gold priced in euros.

EURUSD is now within striking distance of parity and with forecasts from a major investment bank that it will plunge through, the near-term outlook for gold is weak.

Next week's FOMC meeting will be a key event for precious metals as the market looks for clues as to when US rates will be raised.

The sharp rise in the dollar will undoubtedly make the first quarter a very challenging one for US export companies and growth could also suffer which may sway the FOMC towards a less hawkish and for gold supporting stance.

The area around $1,150/oz offered support back in November and so far this has been repeated. A break however would signal a move to and a test of the November low at $1,132/oz. The upside potential is currently limited to $1,176/oz or possibly $1,185/oz while it would take a move back above $1,195/oz to turn the sentiment back to neutral.

Source: Saxo Bank

WTI crude oil was back on the defensive after breaking away from $50 around which it had been trading for the past month. US production and inventories both continue to rise despite a sharp reduction in active oil rigs.

The US's ability to store all this surplus crude has increasingly been attracting some attention, leaving the path of least resistance once again to the downside. The US Energy Information Administration reported on March 4 that US storage facilities were 60% full as of February 20.

The International Energy Agency highlighted this in its monthly report Friday, where it sees the US oil glut worsening leading to a potential test of storage capacity limits. Getting anywhere close to these limits would most likely trigger renewed price weakness in order to force a more substantial cut in production.

The reaction in the market was to send WTI crude oil down to a six-week low, not least due to the widening contango or spread between the prompt future of April and May. Brent crude is currently a bystander and managed a better performance, not least due to the divergence in April/May futures spreads as seen below.

Apart from US inventories, Iran also received some attention as it is reportedly actively seeking potential buyers for the extra crude it will be able to export should the current nuclear negotiations reach a successful conclusion.

The IEA has estimated that Iran would be able to ramp up exports by 800,000 barrels per day in just three months. Imagine what impact this would have on global supplies and the price of Brent crude at this stage.

Iran is reportedly in talks to sell buyers more crude if sanctions are lifted. Photo: iStock.

Furthermore, it would increase pressure on Opec as its total production could then easily surpass 31 million barrels per day, more than one million above their current target. Also considering that Libya, against all the odds, has managed to increase production and exports during the past few weeks despite the anarchy currently witnessed across the war-torn country.

Having left $50/barrels behind and with the cost of holding long positions through exchange-traded products and futures now costing more than 12% to hold over the next three months the risk of further losses have increased. Technically the latest movements signals a move down to $45.3 on CLJ5 followed by this cycle low at $43.58.

Source: Saxo Bank

https://www.tradingfloor.com/posts/hansen-oil-slips-lower-while-gold-looks-dull-3978022

--

About Ole S. Hansen:

Ole Sloth Hansen is a specialist in all traded Futures, with over 20 years’ experience both on the buy and sell side. Hansen joined Saxo Bank in 2008 and is today Head of Commodity Strategy focusing on a diversified range of products from fixed income to commodities. He previously worked for 15 years in London, most recently for a multi-asset Futures and Forex Hedge fund, where he was in charge of the trade execution team. He is available for comments on most commodities, especially energies and precious metals.

About Saxo Bank

Saxo Bank is a leading online trading and investment specialist, offering private investors and institutional clients a complete set of tools for their trading and investment strategies. Its financial community portal, TradingFloor.com, is the first multi-asset social trading platform. A fully licensed and regulated European bank, Saxo Bank enables clients to trade FX, CFDs, ETFs, Stocks, Futures, Options and other derivatives on our award-winning SaxoTrader platform, accessible on PCs, tablets or smartphones through a single account and available in more than 20 languages. The platform is white-labelled by more than 100 major financial institutions worldwide. Saxo Bank also offers professional portfolio and fund management as well as traditional banking services through Saxo Privatbank. Founded in 1992, Saxo Bank is headquartered in Copenhagen and has offices in 25 countries throughout Europe, Asia, the Middle East, Latin America, Africa and Australia.

Share:

ADD TO EYE OF Riyadh

MOST POPULAR

UAE, Costa Rica committed to developing resilient and sustainable economies based on innovation: Al Zeyoudi

Thursday 18 April, 2024 10:10Riyadh Gears Up for the 2024 Islamic Development Bank Group’s Annual Meetings and IsDB Golden Jubilee Celebration

Wednesday 17 April, 2024 10:12Emirates NBD and partners announce second cohort of ‘National Digital Talent Incubator’ program

Wednesday 17 April, 2024 1:04New airlines connecting Kingdom with Africa to be launched soon: Report

Wednesday 17 April, 2024 9:50 ×